From 1 July 2018, you have the ability to catch up on previously missed cap space on tax deductible super contributions – also known as concessional contributions (CCs).

This provides a fantastic opportunity for parents taking time off to raise children, or those on variable levels of income, to catch up on contributions missed in previous years and still have access to the tax benefits down the track.

What are concessional contributions?

Concessional contributions include:

- employer contributions (including superannuation guarantee and contributions made under a salary sacrifice arrangement)

- personal contributions claimed as a tax deduction.

CCs are generally taxed at 15% upon entry to your super fund and are not counted as personal taxable income. If your combined income (includes super contributions) exceeds $250,000 you may pay an effective 30% tax on your concessional contributions.

If you have more than one fund, all CCs made to all of your funds are added together and counted towards the concessional contributions cap.

What is the concessional contributions cap?

Currently the CCs cap is set at $27,500 per financial year. This is set to increase incrementally in line with inflation.

How does the unused concessional cap carry forward work?

From 1 July 2018, if you have a total superannuation balance of less than $500,000 on 30 June of the previous financial year, you may be entitled to contribute more than the general concessional contributions cap and make additional concessional contributions for any unused amounts.

The first year you will be entitled to carry forward unused amounts is the 2019–20 financial year. Unused amounts are available for a maximum of five years, and after this period will expire.

Example:

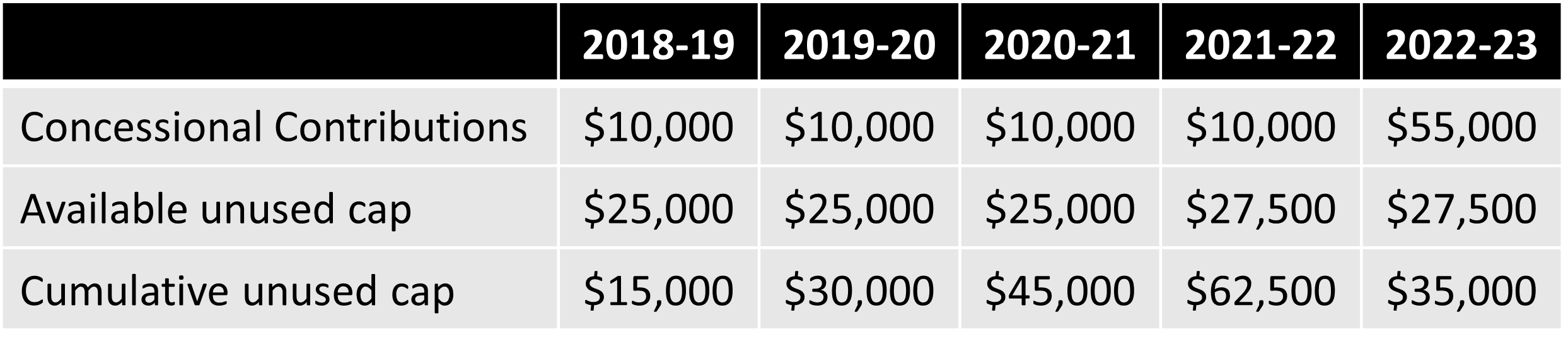

In the 2022-23 financial year Kay intends to use her unused CCs cap amounts to make CCs of $45,000, on top of her employer’s concessional SG contribution of $10,000.

At the end of 30 June 2022 Kay had a total superannuation balance of $480,000 and unused CCs cap amounts from the previous four financial years. She is therefore eligible to make additional CCs in the 2022-23 financial year.

Assuming the CCs cap is $27,500 for the 2022-23 financial year, Kay will have exceeded this cap by $27,500. However, Kay can increase her CCs cap for the 2022-23 financial year by using the full amount of her unused CCs cap from the 2018-19 and 2019-20 financial years.

At the end of 30 June 2023, Kay now has a total superannuation balance of $535,000. This means that Kay will not be able to increase her CCs cap using unused CCs cap amounts in the 2023-24 financial year. However, if Kay’s total superannuation balance later falls below $500,000 she will again be eligible to increase her CCs cap by accessing her unused CCs cap amounts from up to five years prior to the year where she is now eligible to make further contributions.

If you have any questions regarding the above, contact Director and Financial Adviser, Gary Dean at gdean@prosperity.com.au. Alternatively you may contact your Principal Adviser on 1300 795 515 to discuss.

This communication contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).