Australia experienced record levels of inflation in 2022 with Labour Treasurer Jim Chalmers highlighting it as being the ‘biggest challenge in the Australian economy’ today during his October budget announcement.

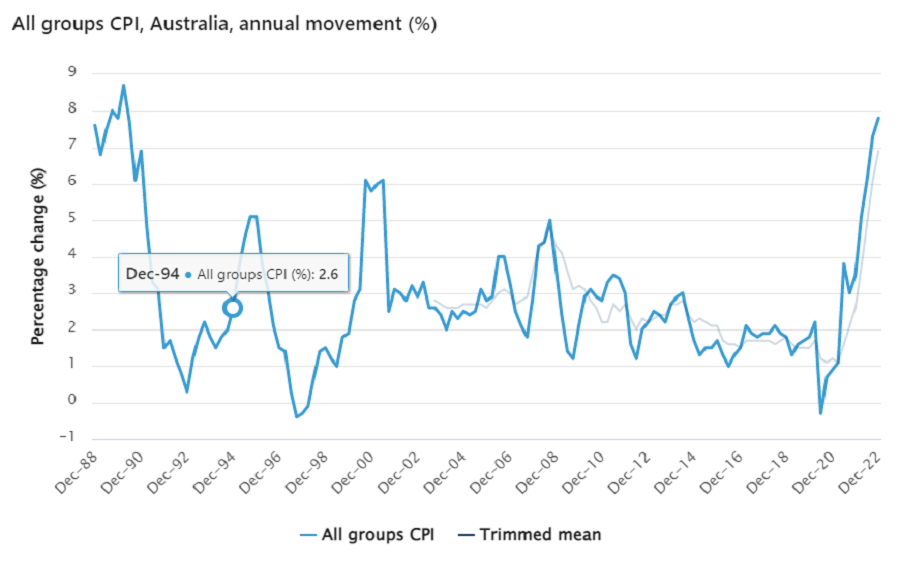

Australia’s measure of Inflation - the Consumer Price Index (CPI) has risen 7.8% over the past year (December Year on Year) the highest annual % rate since 1990 – in comparison the RBA’s cash rate reached 17.50% in 1990 compared to 3.10% today. This high inflation has prompted the RBA into action to raise interest rates 8 times over 2022 with 4 of these being 0.50% (two times the normal rate) and again in February 2023 to combat inflationary pressures.

The RBA chart below highlights this progressive increase in inflation since the 2020 Covid pandemic.

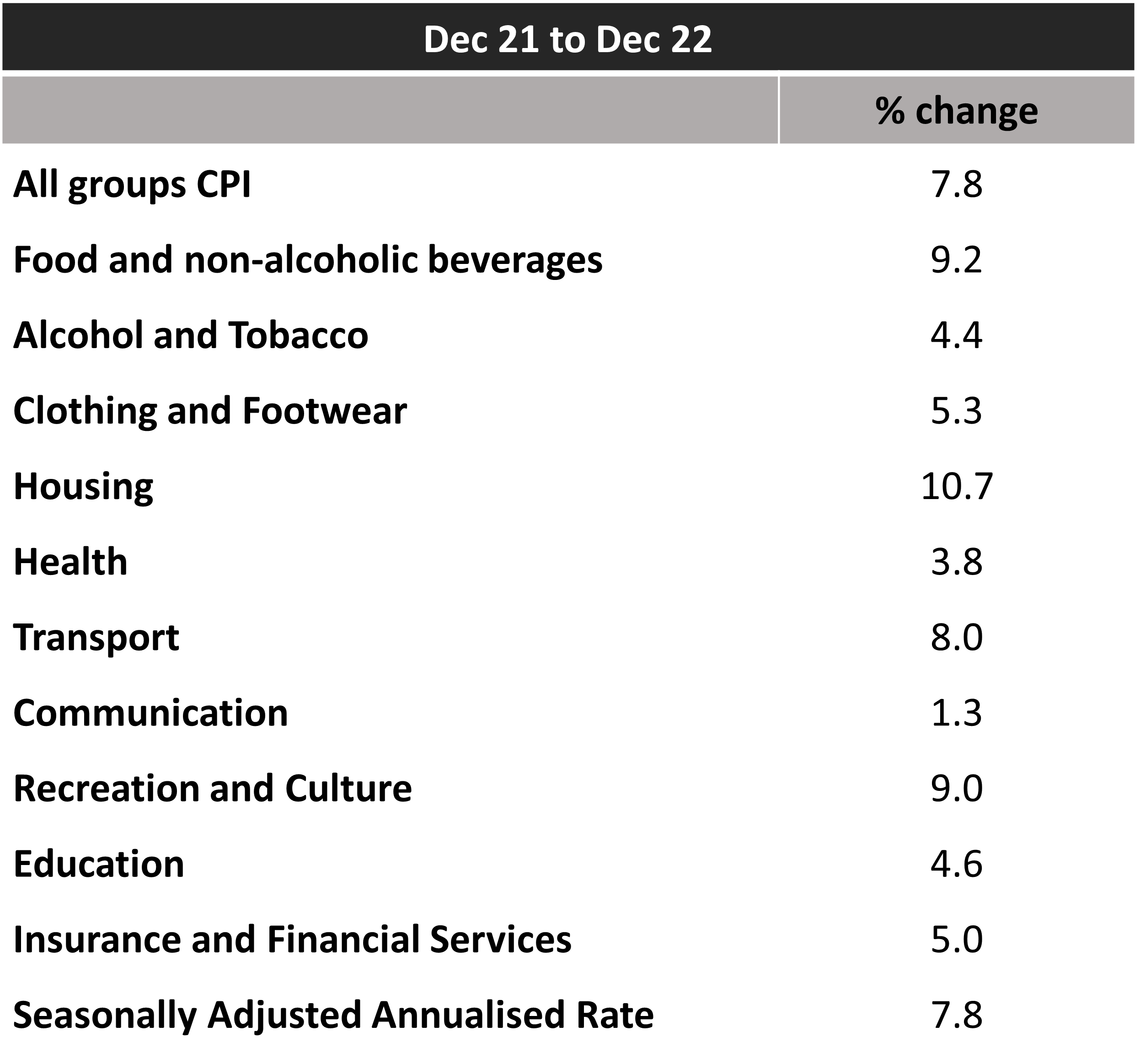

In breaking down these CPI figures (December Year on Year) we can see that there has been material price increases across a broad cross section of pricing groups – outlined below:

Analysing the data

- The services component of the CPI recorded its largest annual rise since 2008, driven by holiday travel and meals out and takeaway food. Annual inflation for goods saw little change from the previous quarter.

- High labour and materials costs continue to drive increases in prices for new dwellings. The rate of price growth has started to ease over the recent quarter following a record annual rise in the September 2022 quarter.

- Strong price rises were seen across most food and non-food grocery products in the December quarter. These increases reflected elevated input costs for farmers and producers of packaged goods, as well as strong Christmas demand. Fruit and vegetables experienced the strongest quarterly fall since 2012, however prices remain elevated compared to 12 months ago.

- Rental price growth in Sydney and Melbourne continued to increase in the September & December quarters, with both cities recording their strongest annual rises since 2014 and 2015 respectively, reflecting a tight rental market. Annual growth in rent prices for the remaining capital cities continues to outpace price growth in Sydney and Melbourne, reflecting lower vacancy rates in those cities.

Is inflation a good thing

It depends on the level of inflation. In Australia the ideal ‘Goldilocks’ zone of inflation is between 2% to 3% but in 2022, it has well and truly exceeded that mark.

The inflation target band of 2-3% was set up in 1993 to provide a discipline for monetary policy decision making and a guide to private sector expectations on inflation with the basic mechanism being that when inflation is above target being a sign that the economy is overheating and/or there are supply side issues whilst when inflation is below target this can be a sign that there is spare capacity in the economy.

Inflation increased rapidly in 2022 due to a range of global and local causes including Putin’s invasion of Ukraine disrupting supply chains and pushing up petrol prices, local natural disasters, and the rising cost of raw materials being passed onto consumers. This has prompted the RBA to embark on a series of aggressive rate hikes to soften demand.

Is the RBA going to pause its aggressive rate hikes any time soon?

In the RBA’s February meeting the Board decided to again increase the cash rate by 0.25% basis points to 3.35%.

The statement from RBA governor Philip Lowe that came with the latest rate hike highlighted that the board “remains resolute in its determination to return inflation to target and will do what is necessary to achieve that”, pointing to the likelihood of further increases given inflation remains elevated.

The RBA recognise that monetary policy operates with a lag and that the full effect of the cumulative increase in interest rates is yet to be felt in mortgage payments.

How to combat the rising cost of living

Everything from the price of a head of lettuce to our monthly mortgage repayments are going up, while wage growth remains stagnant. It’s a tricky combination. So how can you combat the rising cost of living when your budget is already tight?

- Tracking your spending via a budget spending mechanism such as an app / spreadsheet or budget calculator.

- Pay down ‘bad’ non deductible debt.

- Review your mortgage and/or insurance policies to ensure you are paying competitive market rates.

If you have any questions regarding the above, contact Financial Adviser, Phillip Bures at pbures@prosperity.com.au. Alternatively you may contact your Principal Adviser on 1300 795 515 to discuss.

This communication contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Prosperity Wealth Advisers (ABN 32 141 396 376) is an authorised representative of Prosperity Wealth Advisory Services Pty Ltd, Australian Financial Services Licensee (533675).