When you start a new business, the first thing on your mind should be what type of legal structure your business should be operated in.

In Australia, there are broadly four different legal structure types – company, trust, sole trader and partnership. A business is not limited to any particular type of legal structure. You will see businesses run as companies, trusts, sole traders, partnerships, or a combination of one or more of these.

As each type of legal structure has its advantages and disadvantages, there are unfortunately no ‘one-size-fits-all’ approach. Therefore, it is often difficult for first-time business owners to know which type of structure is right for their business? This is where professional advisers like Prosperity can help you navigate the complexities and work with you to find a tailored solution for your circumstances.

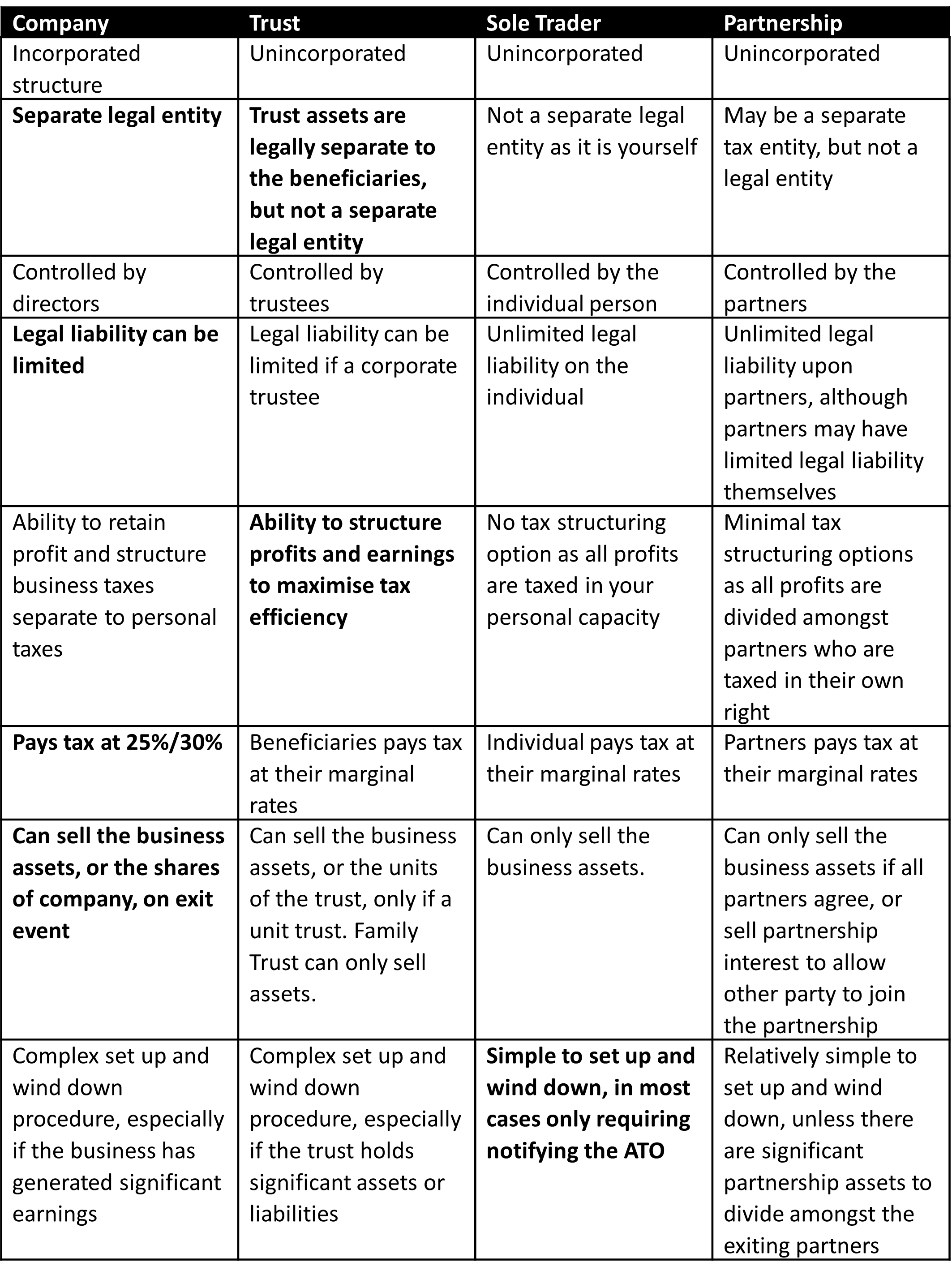

We summarise the key differences between the four structure types in the below table:

Should I incorporate?

One of the key question that should be asked before a decision is made on the legal structure is whether you should incorporate – generally meaning whether you should form a company for the business to operate out of.

As can be seen in the above table, companies have several key differences to other structures, with one of the most important one for business owners being limited legal liability on due to being a separate legal entity. This means a company is treated as its own ‘legal person’ which can sue and be sued in the court of law. This is a very important asset protection strategy to clearly demarcate what are business assets and what are personal/family assets, so that potential creditors to your business cannot sue for any assets of the shareholders outside of the company.

Caution!

While shareholders are protected from the company’s liabilities, directors of the company may be sued in situations where they have acted negligently, provided personal guarantee or indemnity, or are subject to director penalty notices (DPNs). In small businesses, directors and shareholders are normally one and the same person(s), so you should take caution ensuring other protective measures are also taken when in business.

Process of incorporation

In order to incorporate a new company for the operation of your new business, you must first apply to ASIC to register the new company name and pay the registration fee. In the registration process, you will choose the shareholding structure of the company (members), appoint directors and a secretary (officeholders) and adopt a company constitution or the default replaceable rules.

Prosperity provides an all-inclusive service for the incorporation process from start to finish, ensuring the company structure is exactly as you want it to be, and confidence that your new company uses a modern constitution that is regularly reviewed and updated by a major law firm.

What if I change my mind later?

There are no requirements for your business to be locked into any particular legal structure, although bear in mind that a “business” is treated as an asset that can be bought and sold – it may include physical assets such as trading stock or equipment and machinery, or intangible assets such as business know-how, patents and trademarks, and goodwill. This particular point means if you decide to change the legal structure of your business after it has already commenced trading, it can quickly become an expensive exercise involving both significant tax and legal costs.

Prosperity understands that as businesses grows and changes through its lifecycle, both it and its owners’ needs and goals also changes. The business may have outgrown its current structure, you wish to bring in external investors and business partners, or you may be passing the business onto the next generation of your family.

The team at Prosperity has decades of knowledge across a wide suite of corporate and family group restructuring options to help clients like you restructure their businesses in the most tax-efficient and legally-beneficial manner, taking into account your current and future personal and family circumstances.

Read our article on why you should be thinking about a business restructure.

Not incorporating?

If you decide that incorporation is not the right approach for your business, or wish to consider other legal structures in conjunction with a company, there are other options available to you such as a trust structure.

Read on as we explain What is a family trust?

Once you’ve set up the legal structures and started operating your new business, you will also need to consider How should you manage the business’s taxes?

We also discuss other important considerations you need to make for your family and estate planning, with focus on the questions How can I protect my family’s assets? and Do I need insurance and legal agreements?

To discuss any taxation concerns you have regarding business structures, please contact Director of Taxation, Paula Tallon at ptallon@prosperity.com.au or Manager of Taxation, Charles Yuan at cyuan@prosperity.com.au.